The widely used accounting program QuickBooks simplifies financial management for companies of all sizes. To make check printing easier and more efficient, QuickBooks compatible checks are available for purchase online. In this comprehensive guide, we will explore tips and best practices for ordering checks compatible with QuickBooks online. Whether you are a small business owner, an accountant, or a financial professional, this post will provide valuable insights to enhance your check printing process.

Why Choose QuickBooks Compatible Checks?

Choosing checks compatible with QuickBooks offers a myriad of benefits for businesses seeking streamlined financial management. QuickBooks is a widely used accounting software that simplifies various financial tasks, and using checks compatible with this software further enhances its functionality.

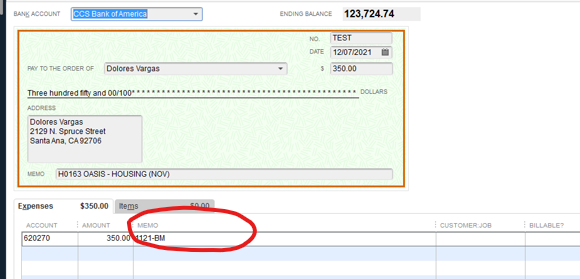

One key advantage is the seamless integration with QuickBooks, which ensures hassle-free printing and accurate record-keeping of transactions. These checks come pre-formatted to align perfectly with the software’s layout, eliminating the need for manual adjustments and reducing the risk of errors.

Moreover, QuickBooks compatible checks offer enhanced security features, safeguarding businesses against fraud and unauthorized alterations. These security measures include tamper-resistant paper, watermarks, and heat-sensitive ink, providing peace of mind when handling sensitive financial information.

Customization options allow businesses to add their logo, business name, and branding elements, promoting a professional and personalized appearance. This branding not only adds a touch of professionalism to checks but also reinforces brand identity.

Tips for Ordering QuickBooks Compatible Checks Online

- Selecting a Trustworthy Supplier for QuickBooks Compatible Checks

Finding a reputable supplier for checks compatible with QuickBooks is of utmost importance to guarantee a seamless financial experience. Conduct thorough research, read customer reviews, and check ratings to identify a reliable supplier with a track record of delivering high-quality products and exceptional customer service.

- Ensure Compatibility with QuickBooks Software

To avoid any compatibility issues, ensure that the checks you order are specifically designed to work seamlessly with your version of QuickBooks. Verify that the supplier provides checks compatible with the QuickBooks software you use, ensuring hassle-free printing and accurate transaction recording.

- Customization Options for a Personalized Touch

Personalize your business checks by choosing a supplier that offers customization options. Look for the ability to add your logo, business name, and other branding elements, giving your checks a professional and unique appearance that represents your brand.

Prioritize Security Features for Enhanced Protection

Safeguard your financial transactions from fraud by selecting checks compatible with QuickBooks that come with robust security features. Look for checks with tamper-resistant paper, secure packaging, watermarks, holograms, and heat-sensitive ink to ensure enhanced security against counterfeiting and unauthorized alterations.

- Consider Bulk Ordering and Cost Savings

For businesses that frequently print checks, consider bulk ordering to take advantage of cost savings. Many suppliers offer discounts for larger quantities, allowing you to save money while ensuring a steady supply of checks for your financial needs.

- Request Samples and Proofing for Peace of Mind

Before committing to a large order, request samples or proofs from the supplier. This allows you to review the check design, layout, and customization options, providing you with the assurance that the final product will meet your expectations and business needs.

- Efficient Turnaround Time for Smooth Operations

In the fast-paced world of business, time efficiency is crucial. Choose a supplier that offers quick turnaround times for order processing and shipping, ensuring you have a continuous supply of checks without any delays affecting your financial operations and cash flow.

Frequently Asked Questions (FAQs)

Q: Can I use any standard checks with QuickBooks?

A: While you can use standard checks with QuickBooks, QuickBooks compatible checks offer better integration and streamlined printing features.

Q: Are QuickBooks compatible checks secure?

A: Yes, QuickBooks compatible checks come with various security features, such as watermarks and heat-sensitive ink, to enhance their security.

Q: Can I add my business logo to QuickBooks compatible checks?

A: Yes, most suppliers offer customization options, allowing you to add your logo and business information to the checks.

Q: How long does it take to receive my ordered checks?

A: The turnaround time varies depending on the supplier and shipping method chosen. Many suppliers offer fast shipping options for quick delivery.

Q: Are QuickBooks compatible checks more expensive than standard checks?

A: While QuickBooks compatible checks may have a slightly higher cost, their efficiency and integration with the software justify the investment.

Q: Are QuickBooks compatible checks compatible with other accounting software?

A: QuickBooks compatible checks are specifically designed for use with QuickBooks and may not be compatible with other accounting software.

Conclusion

Ordering checks compatible with QuickBooks online is a wise choice for businesses seeking an efficient and secure check printing process. By following the tips outlined in this guide, you can ensure a smooth and hassle-free experience when ordering checks compatible with QuickBooks. Investing in high-quality, secure, and customized checks will not only streamline your financial processes but also leave a professional impression on your clients and business partners.